What is Student Loan Deferment?

Maybe you just lost your job, you decided to go back to school, or you got hit with an unexpected...

Enter the $2,000 Nitro Scholarship now! Apply in 3 Minutes!

Nitro Knowledge. Your Guide to Paying for College.

Maybe you just lost your job, you decided to go back to school, or you got hit with an unexpected...

If you want to reduce the monthly bill for your federal student loans, you have a lot of options.

...

If you’re struggling to make your federal student loan payment each month, then you might be...

If you'd like to lower your payment on your federal student loans, you should know that the...

So you've heard about these payment plans that will reduce your monthly student loan bill and...

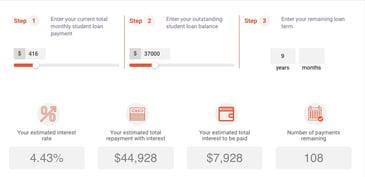

Paying extra on your student loans every month can make a big dent over time—even if you only tack...

Are you tackling a big monthly student loan payment with a salary that isn't as big as you'd hoped?

No matter how much student loan debt you have, it’s the monthly payments that truly impact your...

You knew exactly what life was going to look like when you graduated. You’d get a sweet job, a sick...