How to answer FAFSA® student income tax questions

Here’s a guide for how to correctly fill in your tax filing status and tax return info on the 2024-25 FAFSA®.

Here’s a guide for how to correctly fill in your tax filing status and tax return info on the 2024-25 FAFSA®.

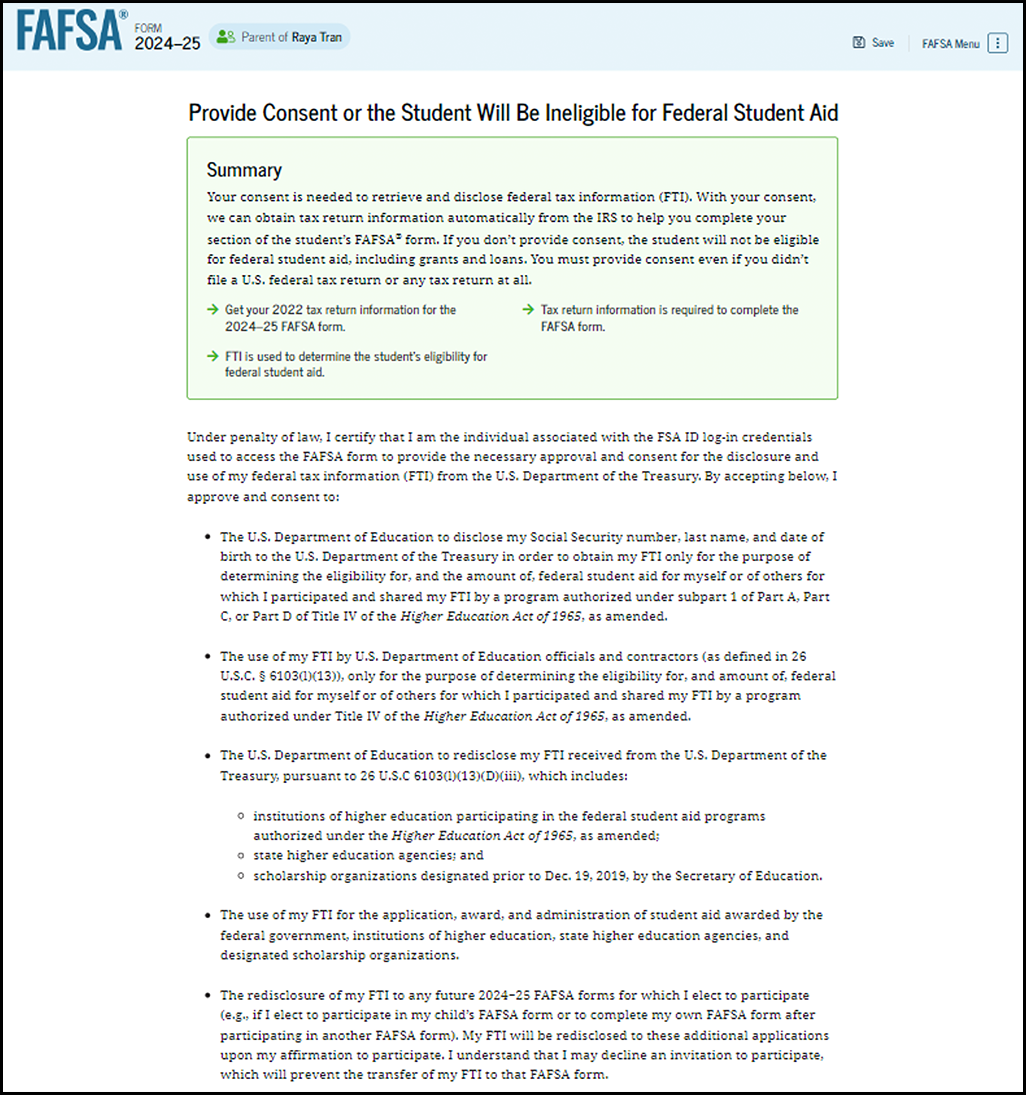

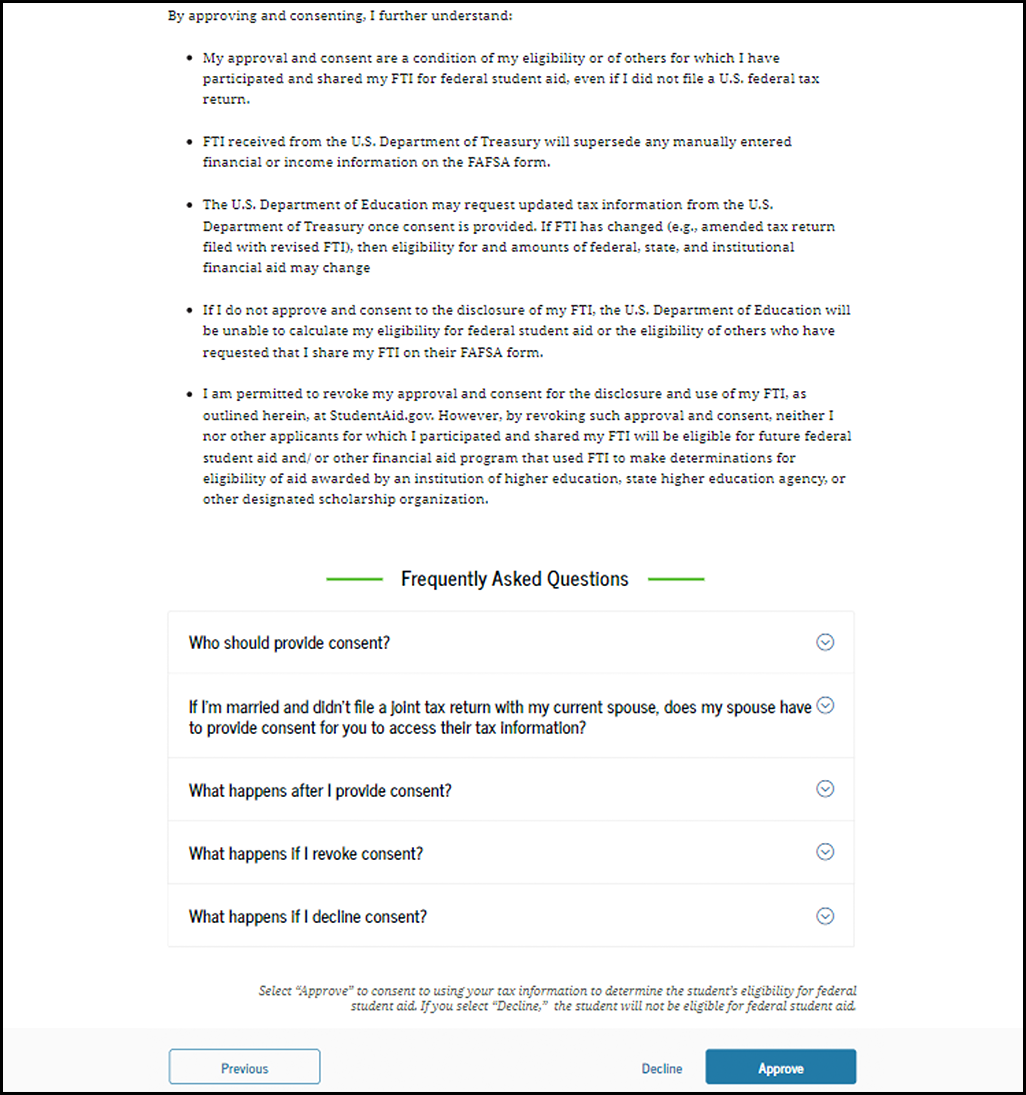

Refer to the consent terms on page 4. By filling in the answer circle below and signing this form, the student agrees to the terms set forth on page 4. If the student does not provide consent by filling in the circle and providing their signature, we cannot process this FAFSA form.

Consent to transfer federal tax information from the Internal Revenue Service (IRS)

Student signature

Date signed

MM/DD/YYYY

Enter to win $2,000 for college*

*No purchase necessary. Void where prohibited. Ends December 31, 2024. See Official Rules.

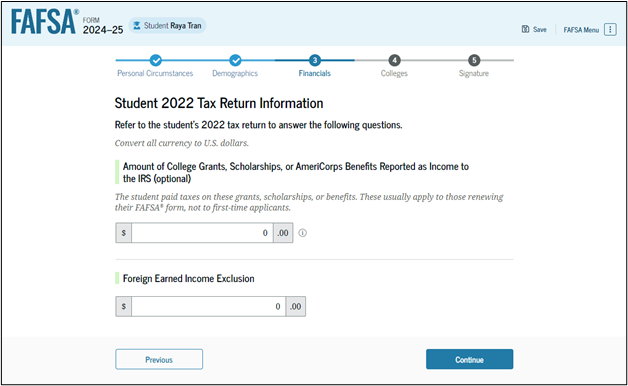

Convert all currency to U.S. dollars. If the answer is zero or the question does not apply, enter 0.

If the answer is negative, completely fill the circle ( – ) after the answer box.

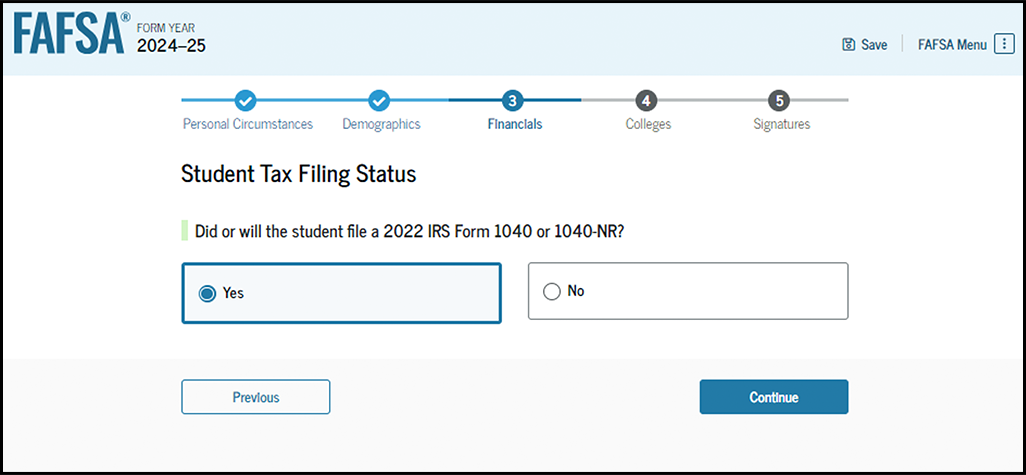

Filing status

Single

Head of household

Married filing jointly

Married filing separately

Qualifying surviving spouse

IRS Form 1040—line 1 (or IRS Form 1040-NR—line 1a) +

Schedule 1—lines 3 + 6

IRS Form 1040: line 2a

IRS Form 1040: line 4a minus 4b

IRS Form 5498

IRS Form 1040: line 5a minus 5b

IRS Form 5498

IRS Form 1040: line 11

IRS Form 1040: line 25d

IRS Form 1040: line 27a

Yes

No

Don’t know

SEP, SIMPLE, and qualified plans

IRS Form 1040 Schedule 1: total of lines 16 + 20

(American Opportunity and Lifetime Learning credits)

IRS Form 1040 Schedule 3: line 3

with their 2022 IRS Form 1040?

Yes

No

Don’t know

Schedule C

IRS Form 1040 Schedule C: line 31

The student paid taxes on these grants, scholarships, or benefits. These usually apply to those renewing their FAFSA form, not to first-time applicants.

IRS Form 1040 Schedule 1: line 8d

Choose the FAFSA® questions you would like help with

FAFSA® student income tax information