How to answer parent income tax questions on the FAFSA®

Here’s how to correctly answer 2024-25 FAFSA® parent tax questions, provide consent for IRS electronic information transfer, and add your signature.

Here’s how to correctly answer 2024-25 FAFSA® parent tax questions, provide consent for IRS electronic information transfer, and add your signature.

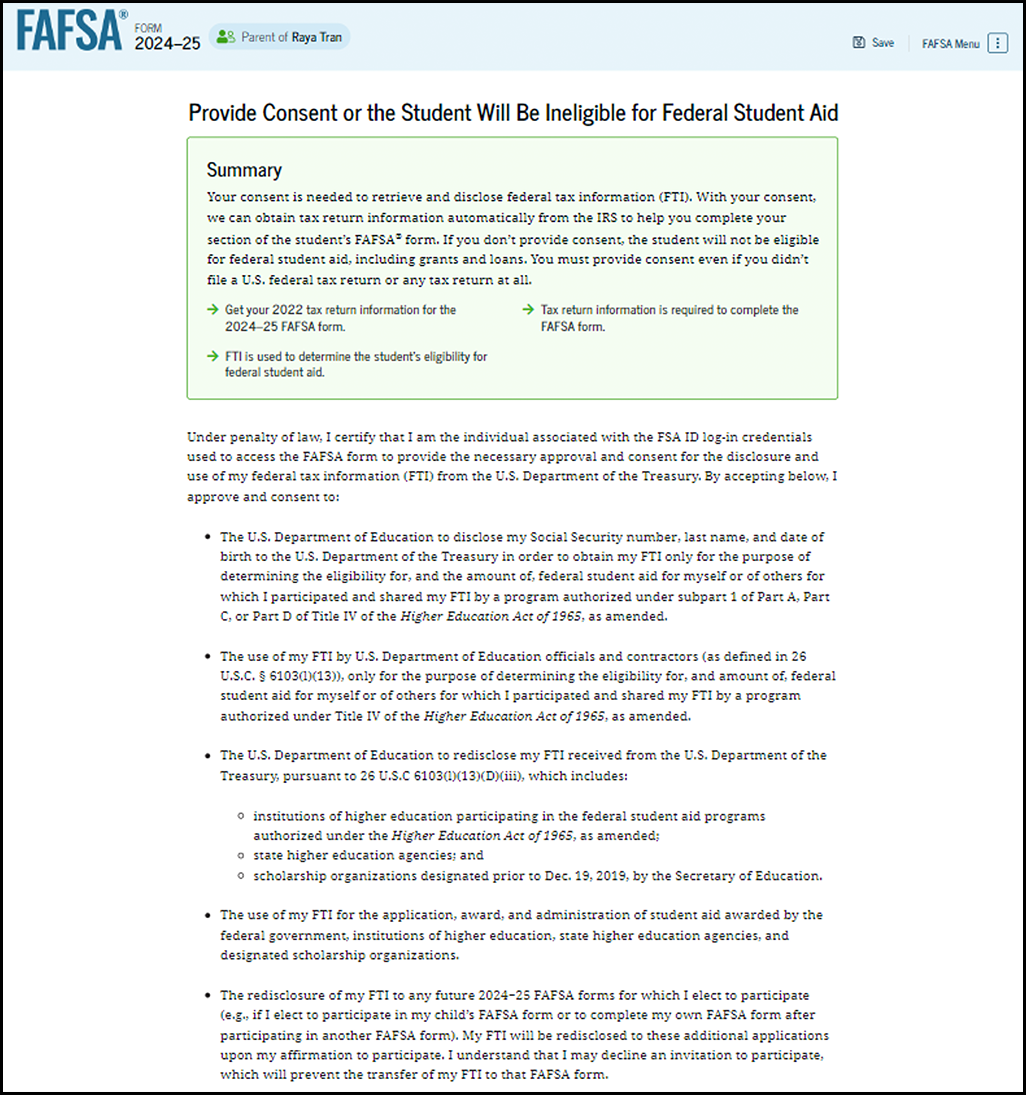

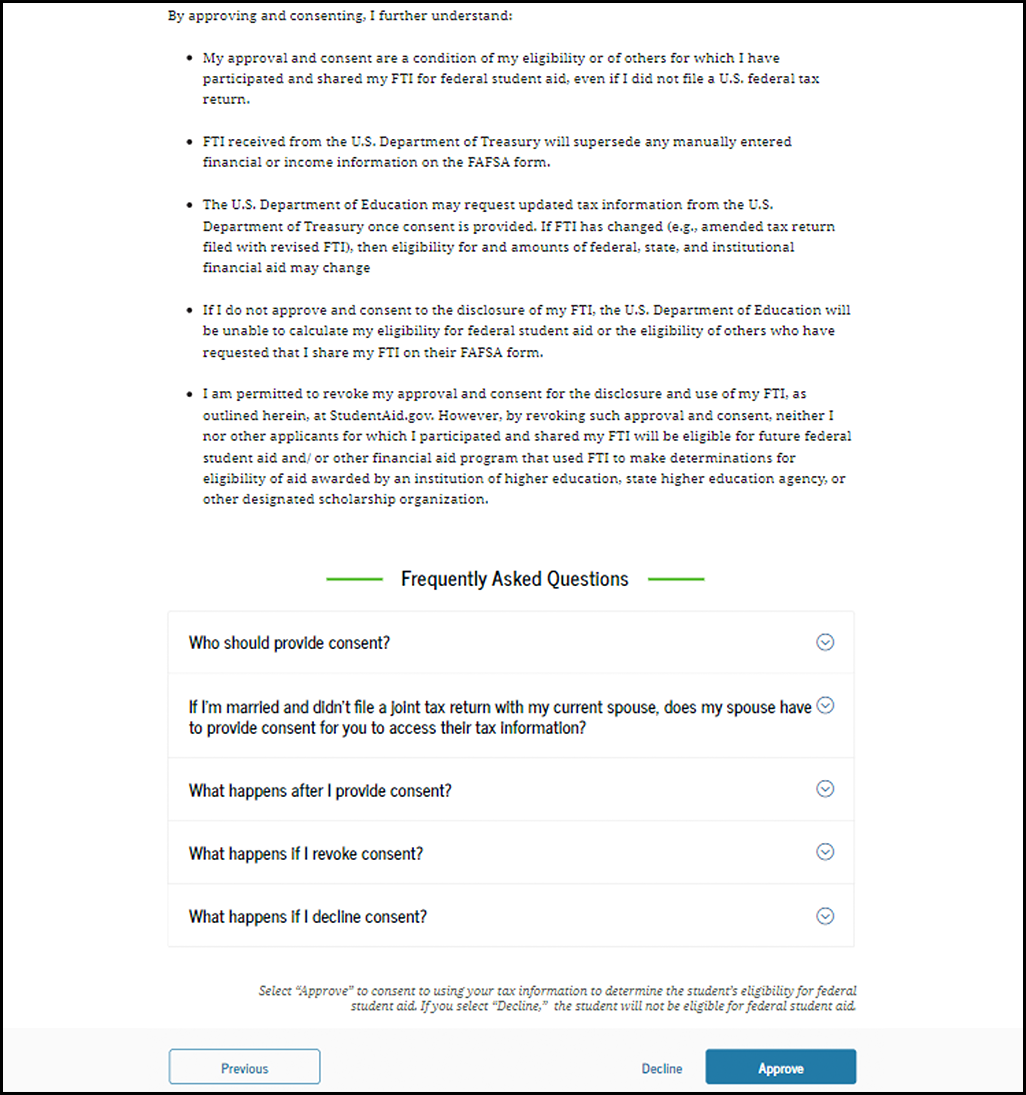

Refer to the consent terms on page 4. By filling in the answer circle below and signing this form, the parent agrees to the terms set forth on page 4. If the parent does not provide consent by filling in the circle and providing their signature, we cannot process this FAFSA form.

Enter to win $2,000 for college*

*No purchase necessary. Void where prohibited. Ends December 31, 2024. See Official Rules.

Did or will the parent file a 2022 IRS Form 1040 or 1040-NR?

Yes

No

If the answer is “No,” indicate which one of the following situations applies to the parent for 2022: If one of the options in the second column below is selected and the parent is unmarried, questions 38-40 can be skipped.

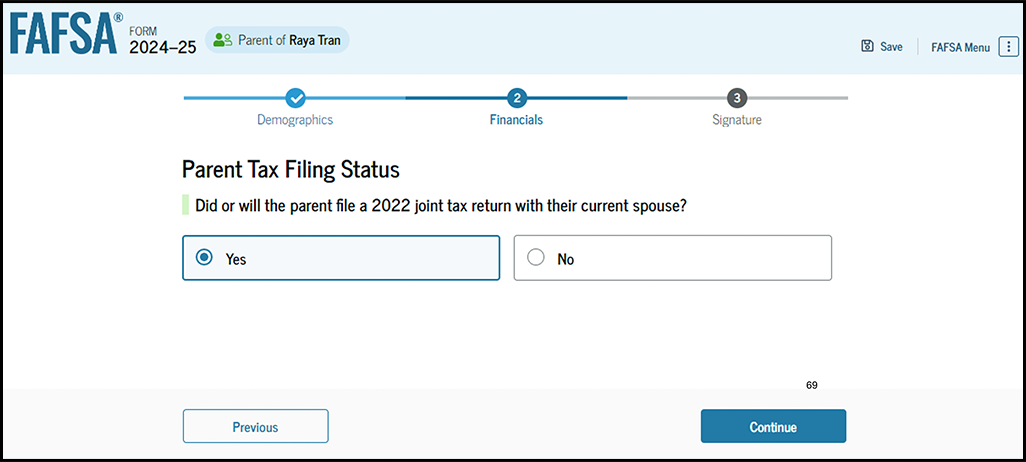

Did or will the parent file a 2022 joint tax return with their spouse?

Yes

No

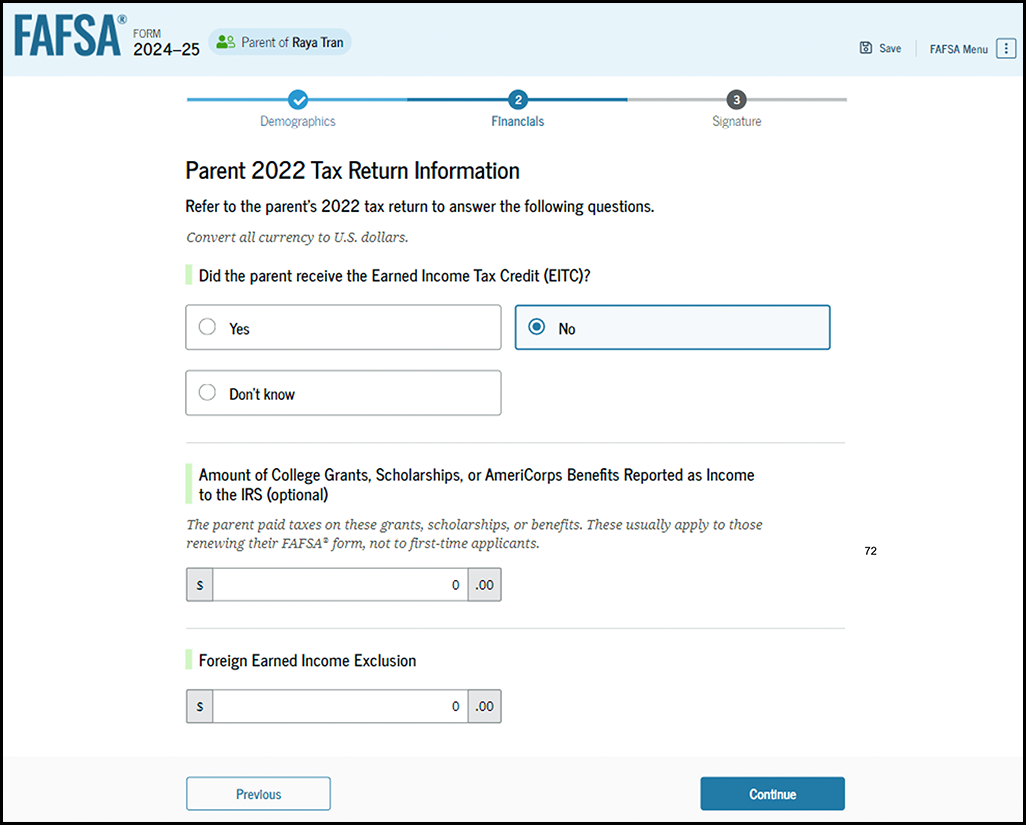

Convert all currency to U.S. dollars. If the answer is zero or the question does not apply, enter 0.

If the answer is negative, completely fill the circle ( – ) after the answer box.

Single

Head of household

Married filing jointly

Married filing separately

Qualifying surviving spouse

IRS Form 1040—line 1 (or IRS Form 1040-NR—line 1a) +

Schedule 1—lines 3 + 6

IRS Form 1040: line 2a

IRS Form 1040: line 4a minus 4b

IRS Form 5498

IRS Form 1040: line 5a minus 5b

IRS Form 5498

IRS Form 1040: line 11

IRS Form 1040: line 25d

Yes

No

Don’t know

SEP, SIMPLE, and qualified plans

IRS Form 1040 Schedule 1: total of lines 16 + 20

(American Opportunity and Lifetime Learning credits)

IRS Form 1040 Schedule 3: line 3

Yes

No

Don’t know

IRS Form 1040 Schedule C: line 31

The parent paid taxes on these grants, scholarships, or benefits. These usually apply to those renewing their FAFSA form, not to first-time applicants.

IRS Form 1040 Schedule 1: line 8d

No, but you can answer zero (0) if you didn’t receive child support.

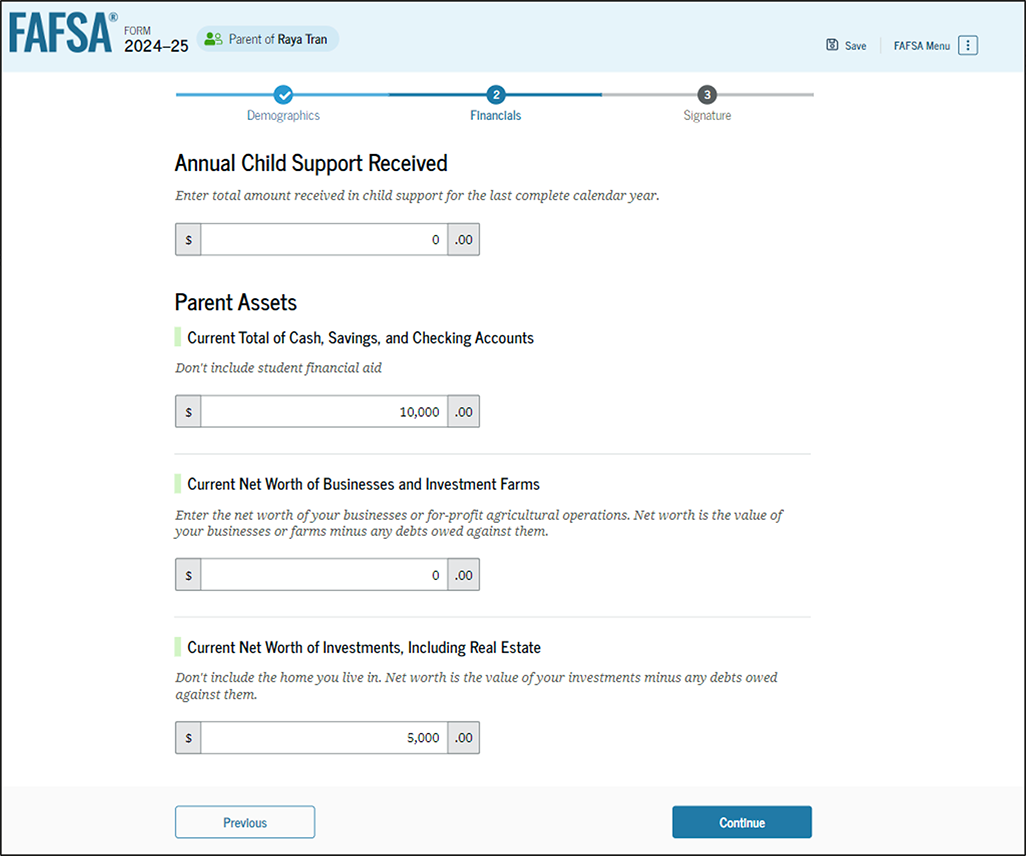

Enter total amount the parent received in child support for the last complete calendar year. If the answer to question 32 was “Married,” “Remarried,” or “Unmarried and both legal parents living together,” enter the combined amount the parent and their spouse received.

The FAFSA® requires details about your (and your spouse’s, if you’re married) financial assets to help calculate your student’s financial need.

No

Net worth means the current value, as of today, of investments, businesses, and/or investment farms, minus debts related to those same investments, businesses, and/or investment farms. When calculating net worth, use 0 for investments or properties with a negative value.

Investments include real estate (do not include the home in which you live), rental property (which may include a unit within a family home that has its own entrance, kitchen, and bath rented to someone other than a family member), trust funds, UGMA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds, other securities, installment and land sale contracts (including mortgages held), commodities, etc.

Investments also include qualified educational benefits or education savings accounts (e.g., Coverdell savings accounts, 529 college savings plans, and the refund value of 529 prepaid tuition plans). For a student who does not report parental information, the accounts owned by the student (and/or the student’s spouse) are reported as student investments in question 22. For a student who must report parental information, the accounts are reported as parental investments in question 40, including all accounts owned by the student and all accounts owned by the parents for any member of the household.

Investments do not include the home you live in, the value of life insurance, ABLE accounts, retirement plans (401[k] plans, pension funds, annuities, non-education IRAs, Keogh plans, etc.) or cash, savings and checking accounts reported in the previous question.

Investments also do not include UGMA and UTMA accounts for which you are the custodian, but not the owner.

Investment value means the current balance or market value of these investments as of today. Investment debt means only those debts that are related to the investments.

Business and/or investment farm value includes the market value of land, buildings, machinery, equipment, inventory, etc. Business and/or investment farm debt means only those debts for which the business or investment farm was used as collateral.

If the answer to question 32 was “Married” or “Remarried,” or “Unmarried and both legal parents living together,” enter the combined amounts held by the parent and their spouse.

Current total of cash, savings, and checking accounts

$

Don't include student financial aid.

Current net worth of investments, including real estate

$

Don’t include the home the student lives in.

Net worth is the value of the investments minus any debts owed against them.

Current net worth of businesses and investment farms

$

Enter the net worth of the parent’s businesses or for-profit agricultural operations. Net worth is the value of the businesses or farms minus any debts owed against them.

Choose the FAFSA® questions you would like help with

FAFSA® student income tax information