What is the True Cost of a Harvard MBA?

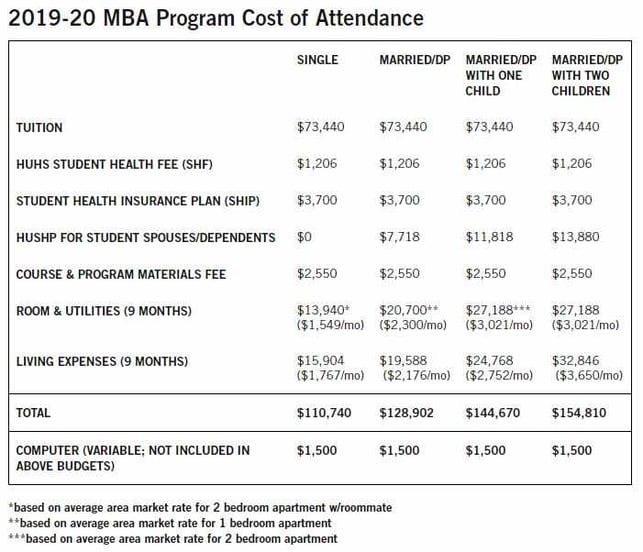

What is the cost of Harvard MBA, including tuition, fees, and room and board? Tuition alone is $73,440 annually. When you take into account fees, room and board, and living expenses, that number rises to $110,740 per year.

Since it takes two years of full-time study to complete the program, you'll need to double those costs ($146,880 for tuition, and $221,480 for the everything). However, that doesn't tell the whole story, since the sticker price is not what you'll actually pay. Let's take a closer look at what you can expect.

Yearly cost for tuition, fees, and room and board

Without financial aid or scholarships, here's what you can expect to pay annually while pursuing your MBA at Harvard. (Remember to double each column for the total cost of the two-year program.)

Keep in mind that if you opt for off-campus housing, you may be required to sign a 12-month lease, even though the academic year is only nine months.

Scholarships and fellowships abound

The good news is that less than half of Harvard Business School students pay the full price for their MBA, according to Poets & Quants, a blog focused on graduate business education.

Among the aid offered by Harvard Business School is the need-based HBS Scholarship that you don't have to repay. You must apply for this scholarship after being admitted to the school.

Here are the fast facts about this scholarship:

- The majority of awards are around $40,000, or a total of $80,000 for the two-year program.

- Nearly 50% of HBS students are eligible for these need-based fellowships.

- You can apply for up to $30,000 in outside scholarships without impacting the amount of your HBS Scholarship award.

Outside funding sources

Outside scholarships and grants, which do not have to be repaid, can curb the remaining costs. In fact, HBS recommends that all students look for outside funds to help with the cost of the school. The school lists a number of scholarship opportunities on its website. You can also search in our constantly-updated search engine dedicated to Scholarships for Graduate Students.

Many Harvard MBA candidates turn to student loans to cover funding gaps. According to HBS, the average MBA student graduates with about $90,000 in student loan debt.

Graduate students are eligible to borrow $20,500 in federal student loans dollars from the U.S. Department of Education per year. However, keep in mind that federal loans for grad school come at a higher interest rate than undergrad loans. Direct loans are currently being offered at 6.08% and PLUS loans at 7.08%.

However, if you have good credit, you may be able to score a lower interest rate through a private lender. As of January 2020, some lenders are offering fixed rate loans at rates as low as 4.26%.

See also: The Nitro Guide to Getting a Private Student Loan

Is a Harvard MBA worth it?

The question of whether a Harvard MBA is worth the money is subjective. First, you have to consider the financial implications. Is the school attainable and affordable in your situation? Are you committed to finding outside funding, or are you OK with taking on student loan debt in order to advance in your career?

There are also other considerations. HBS dean Nitin Nohria told Business Insider that the program is best for developing general management skills, rather than specializing in a particular field.

"We're looking for people who really enjoy the responsibility of running a company, or want to run a company," Nohria told Business Insider. "If you have a very special interest in a particular thing, other schools may be better suited to you."

(Though, apparently, research shows that generalist MBA grads get better job offers than MBA grads who specialize in a single area.)

You also have to understand the implications of student loan debt. As The Christian Science Monitor reported in 2012, Harvard Business School graduates are sometimes saddled with six-figure debt because they never questioned the value of a MBA. "I assumed all would take care of itself; that I would go to Harvard, get a high-paying job, and everything would be OK," one graduate said. "I was completely naive."

If you do choose to attend Harvard or another grad school, use our College Cost Calculator, which will help you interpret your financial aid letter and determine the amount of loans you'll need.