Everyone makes mistakes. By the time most people have crested out of their 20s and into older adulthood, experts say it’s not uncommon to look back and wish some things had been done differently. Maybe you spent too much time focused on work and not enough at home with family. You might think you’ve invested in the wrong career choice or maybe not taken care of your body well enough.

Whatever it is, in most cases it’s not too late to make a change. Few things in life are permanent after all, and there’s nothing wrong with deciding to take a different path when it comes to your career or personal life.

But not all mistakes are easily corrected. If you’ve made financial mistakes in the past, overcoming them could be easier said than done. Sure, you can always refinance your student loans, but a poor credit score, dangerous spending habits, or lackluster savings might end up haunting you for years to come.

So what are some of the money matters keeping people up at night, and how are millennials and Gen Zers thinking about their financial futures? To learn more, we asked 1,000 people what financial advice they had for younger people and discovered the youngest generations might already be thinking about their financial futures.Money on the Mind

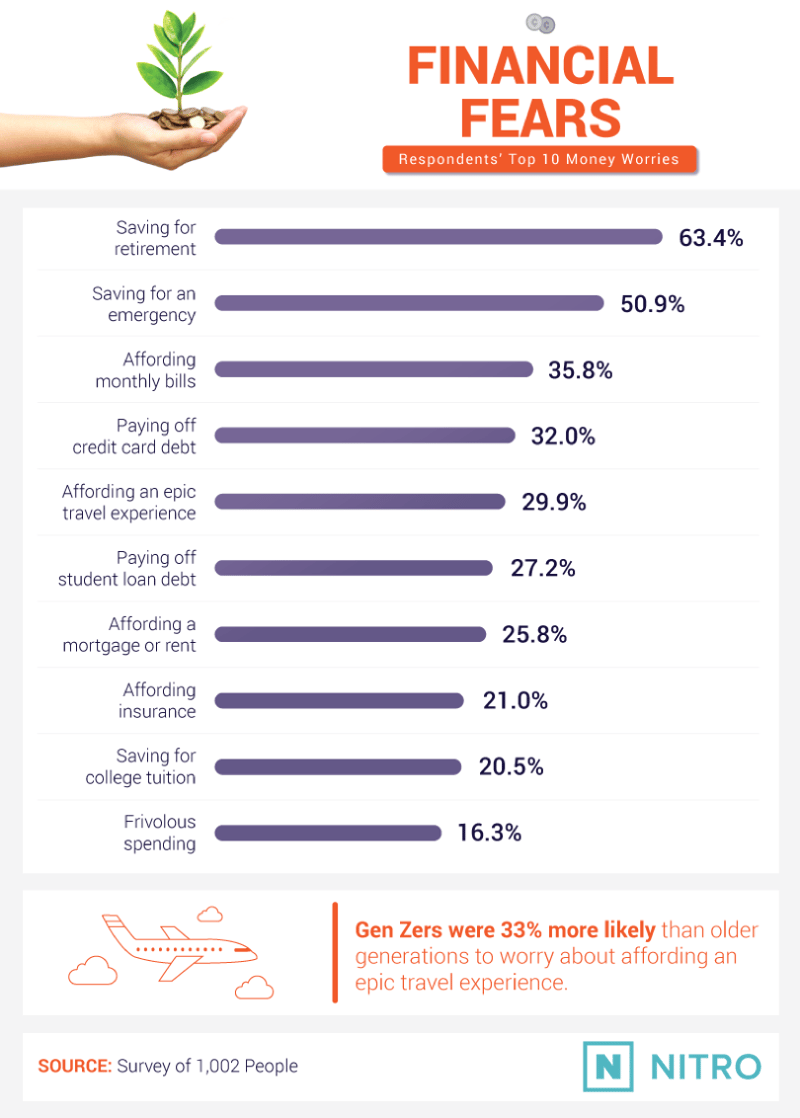

When it comes to the biggest financial concerns, one issue is front and center for most people: retirement. Research has shown a vast majority of people have less than $1,000 saved in any capacity, and nearly half of families have no retirement savings at all. To retire comfortably, experts recommend having five times your annual salary saved before turning 50 and seven times your yearly salary by age 60. For over 63% of people, saving for retirement was their biggest money worry.

While more than half of people were worried about saving for an emergency fund, over 1 in 3 worried about affording their monthly bills, and 32% worried about paying off credit card debt.

Of course, some financial fears are more serious than others. While some people look ahead to their financial futures with uncertainty, others may be thinking about more casual concerns. Nearly 30% of people were worried about affording an epic travel experience, a concern that was 33% more likely to occur among Gen Zers than any other group.

Putting Money to Work

Millennials are now between the ages of 22 and 37. Gen Zers, those born from 1997 onward, are also starting to come into their own financially. Millennials are often credited for changing much of the modern landscape, but researchers suggest Gen Zers could have an even more profound effect on the future.

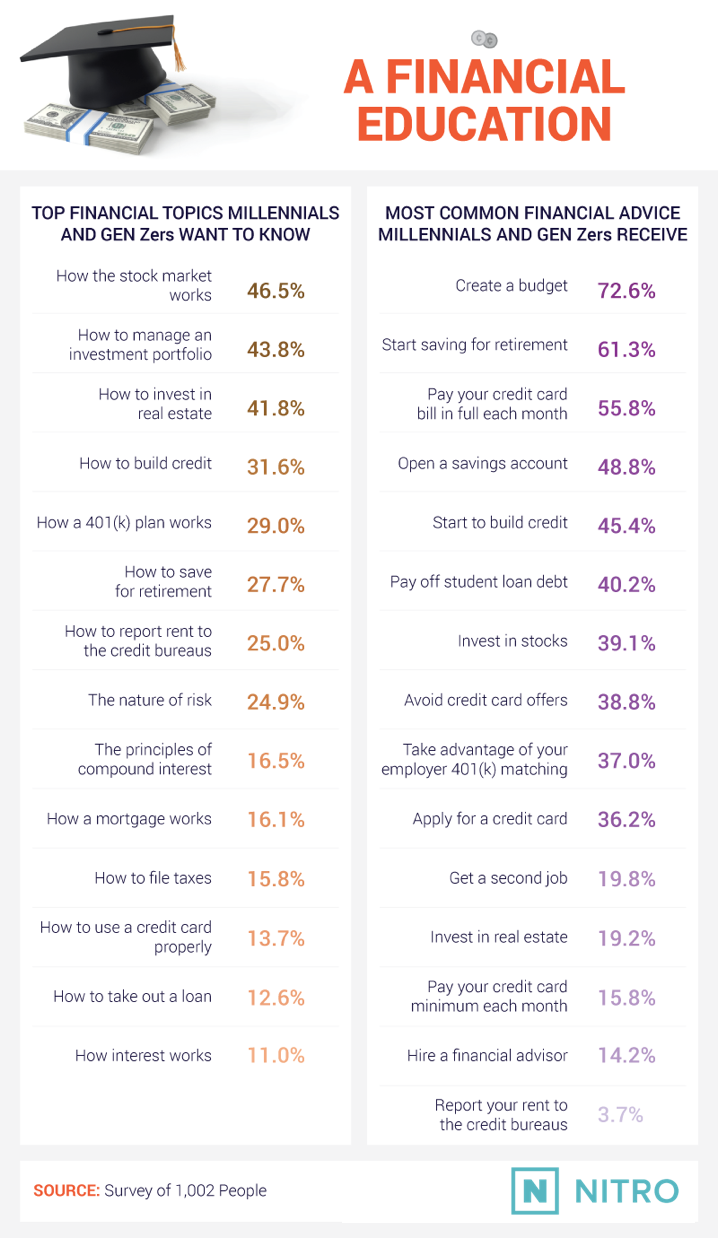

The most pressing concerns among young people polled wasn’t funding a vacation or spending frivolously; it was learning how to invest. Nearly 47% of millennials and Gen Zers said they wanted to learn how the stock market worked. Almost another 44% suggested they wanted to learn how to manage an investment portfolio, while roughly 42% wanted to learn how to invest in real estate.

The advice these generations are receiving, though, might not match up with the questions they’re asking. Nearly 73% of millennials and Gen Zers said the advice they got was typically related to creating a budget, while a little over 61% said they were told to start saving for retirement. Despite wanting to learn more about investing, only around 39% of young people said they got advice on how the stock market worked.

Although older generations aren’t necessarily giving young people the advice they’re looking for, baby boomers and Gen Xers know a thing or two about money matters.

When asked what they wish they’d known at a younger age, baby boomers and Gen Xers admitted learning how to invest properly might have been more important than talking about saving or budgeting. Learning the ins and outs of the stock market ranked above learning the proper way to save for retirement, followed by how to make money by investing in real estate.

Words of Wisdom

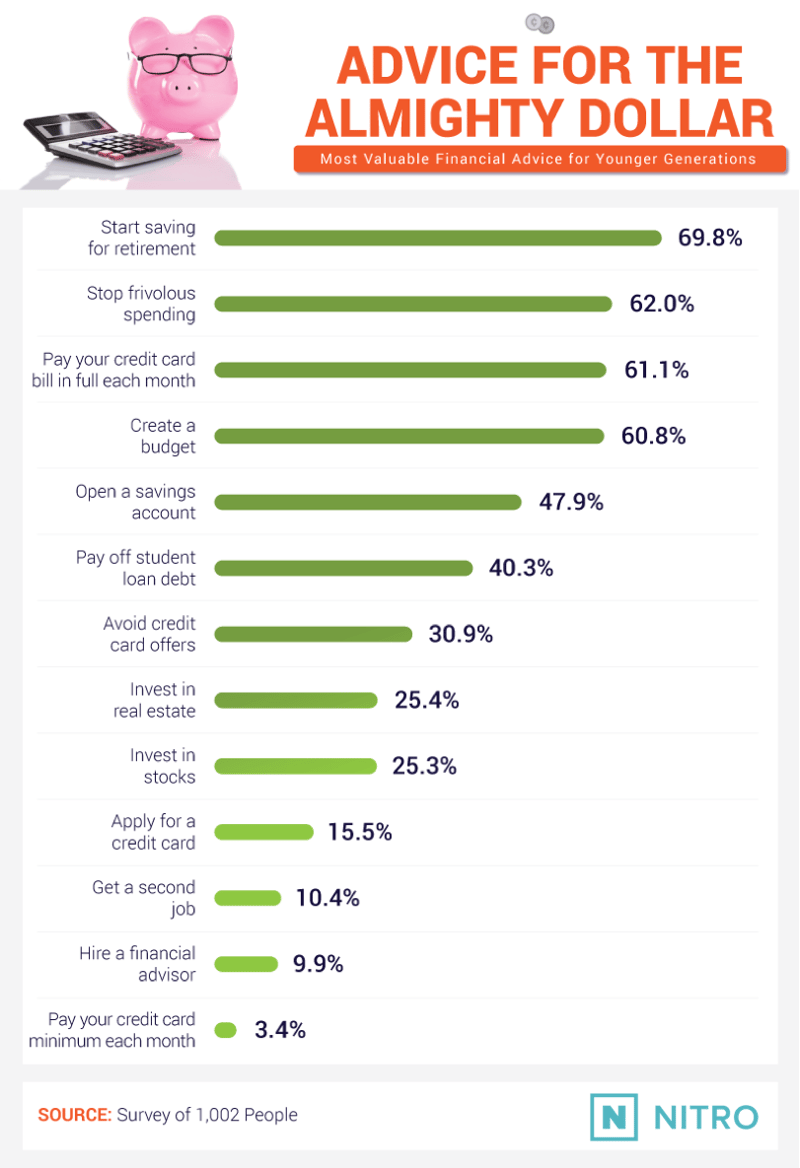

Young people might be more concerned with getting their first job than thinking about retirement, but that probably won’t stop older generations from talking to them about it anyway. Nearly 70% of people admitted the most important financial advice to pass on to younger generations was starting to save for retirement.

There’s more to saving for retirement than thinking about your 401(k), however – investing in the stock market, taking advantage of other bond options, and even dabbling in real estate can help get you where you’re trying to go.

And even if they don’t want to hear it, older generations still believe younger people should stop frivolous spending. Too many trips to Starbucks? Travel expenses you can’t afford? Cut them out, and you could save serious cash year over year.

Hitting a Learning Curve

Most people who’ve run into financial difficulty know the consequences of these challenges can stay with them for years. Financial experts recognize there are certain facts about managing money all young people should know, but it can be challenging to learn these lessons in time. Most millennials and Gen Zers aren’t picking up stock tips or investing advice from their college lectures, and that might be putting them at a disadvantage as they transition into financial independence and adulthood.

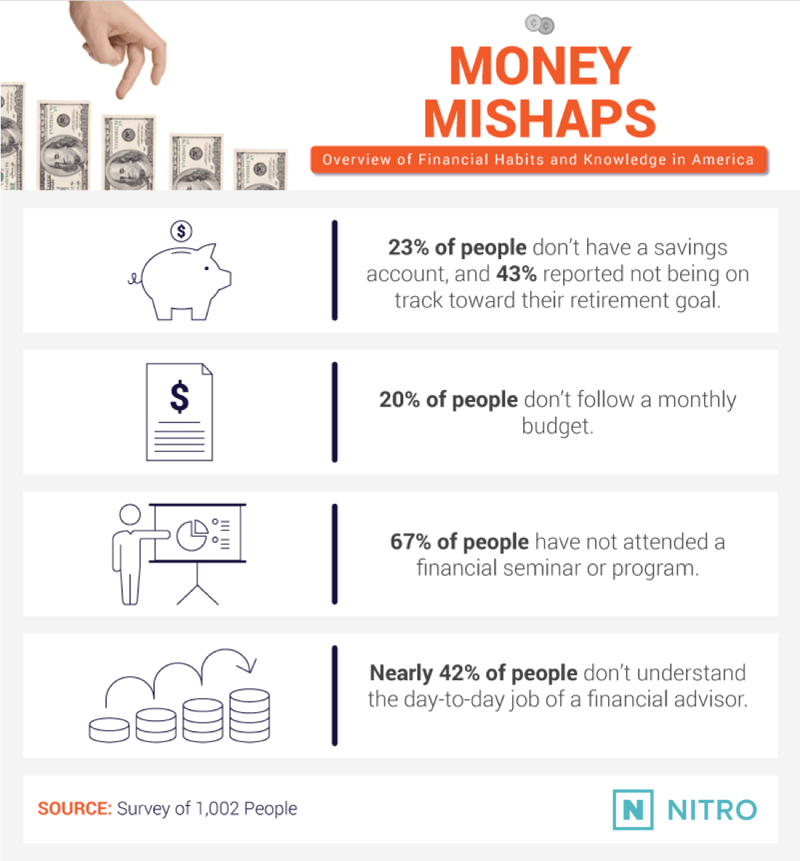

In some cases, even the most fundamental aspects of money management take time to develop. A hefty 23% of people reported not having a savings account, and more than 2 in 5 (43%) admitted they weren’t currently on track with their retirement goals. Another 1 in 5 people said they didn’t currently follow a monthly budget.

Asking for help with the things you don’t understand might be more challenging. More than 2 in 3 people hadn’t attended a financial seminar or program, and nearly 42% said they didn’t understand the day-to-day job of a financial advisor.Teamwork Makes the Money Work

So what is a financial advisor, and when should you consider utilizing one to manage your money? Sometimes referred to as “investment advisors,” financial advisors are available to help you plan for long-term investment opportunities.

Considering their professional and often in-depth knowledge of managing money, financial advisors also help advise everyday spenders on their tax considerations. Setting your long-term money goals can be a daunting task, but figuring out how to get there can be even more stressful. Financial advisors often exist to help alleviate that burden.

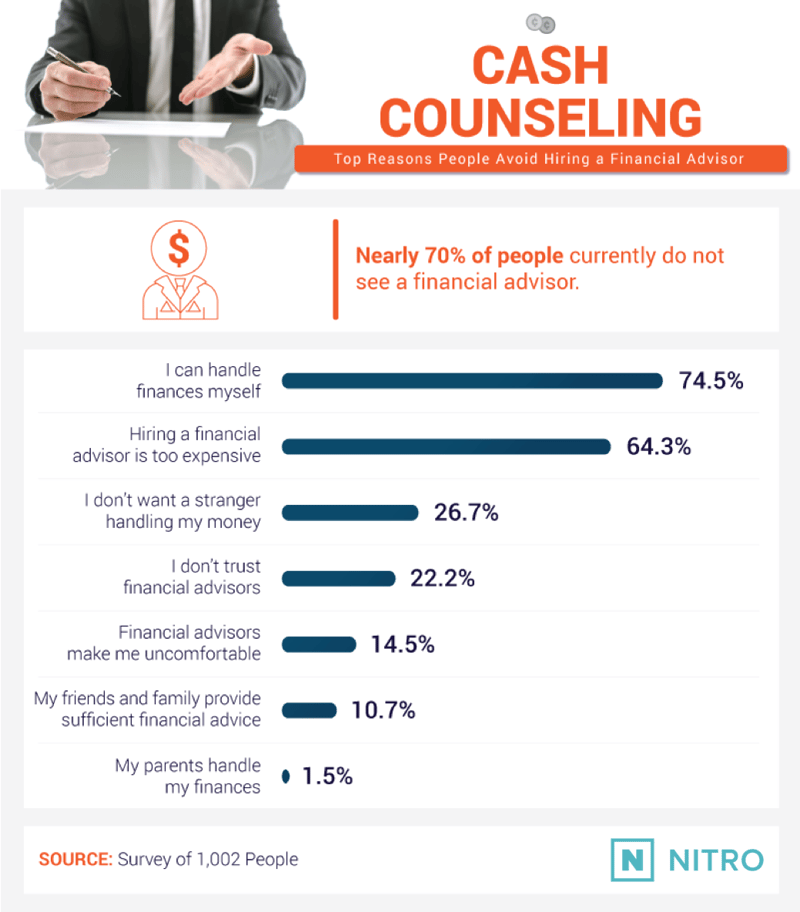

Despite the pros of hiring a financial advisor, nearly 70% of people didn’t currently use one, primarily because they believed they could handle their finances independently. Another 2 in 3 people though hiring a financial advisor would be too expensive, and roughly 1 in 4 were cautious about having a stranger managing their money.

Planning for the Future

If planning for your financial future has you confused or you don’t feel like you’re getting the advice you need, you aren’t alone. While older generations are focused on saving for retirement and budgeting their savings, younger people have their eyes on investment opportunities like the stock market or real estate.

The end goal might be the same in both cases, but the execution of a healthy financial future for millennials and Gen Zers may look different than it has in years past. While most people aren’t using financial advisors to manage their money, Gen Zers were twice as likely as millennials to utilize automated advisor solutions to manage their investments online.

At Nitro, our mission to help you plan for the future starts with student loans. The average student loan debt is over $37,000, which can be the difference for people who are buying their first car or investing in real estate. By providing clear and transparent options for refinancing your student loans with our trusted network of lenders, Nitro has the professional loan refinancing solutions you need. Take control of your money today. Visit us at Nitro to learn more.

Methodology

For this campaign, we polled 1,002 people from Amazon’s Mechanical Turk about their financial knowledge, habits, and advice (received and given). Respondents were disqualified if they failed attention check questions or entered inconsistent data throughout the survey. Each generation examined had a minimum sample size of 100 participants. Younger generations are defined as millennials and Gen Zers, while older generations consist of baby boomers and Gen Xers.

The presented data rely solely on self-reporting. Self-reported data are typically paired with several issues. Some of these issues include but are not limited to: telescoping, exaggeration, attribution, and selective memory.

No statistical testing was performed for this study, so the claims presented above are based on means alone. This report is purely exploratory, and future research attempts should approach this topic more rigorously.

Sources

- https://bestlifeonline.com/most-common-regrets-people-have/

- https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/2018-05-22/how-past-money-mistakes-can-shape-your-financial-future

- https://www.cnbc.com/2017/06/13/heres-how-many-americans-have-nothing-at-all-saved-for-retirement.html

- http://www.pewresearch.org/fact-tank/2018/03/01/defining-generations-where-millennials-end-and-post-millennials-begin/

- https://www.inc.com/ryan-jenkins/who-is-generation-z-4-big-ways-they-will-be-different.html

- https://www.forbes.com/sites/quora/2017/08/02/what-should-all-young-people-know-about-managing-money/#1fd446b3325e

- https://money.usnews.com/money/blogs/on-retirement/articles/2016-07-20/the-pros-and-cons-of-hiring-a-financial-advisor

- https://www.cnbc.com/2018/04/06/how-to-make-sure-youre-investing-with-the-right-robo-advisor.html

Fair Use Statement

Have some financial advice you’d like to share? We’d love to see the results of this study published on your site for any noncommercial use. Just ensure a link back to this page so that our contributors get credit for their work too.