The Best Ways To Build Credit

Building credit can seem like the ultimate Catch-22: You need a good score to borrow money, but you need to borrow money to get a good score. This system leaves millions of Americans confused about where to start, unsure of what they can do to break this cycle of credit exclusion.

According to the latest Consumer Financial Protection Bureau numbers, 26 million adults are credit invisible, meaning credit reporting agencies have no data available for potential lenders.

Another 19 million people have credit histories so limited or outdated that their credit can’t be scored. The vast majority of lenders can’t work with those who fall into these categories, even if their finances are healthy in other respects.

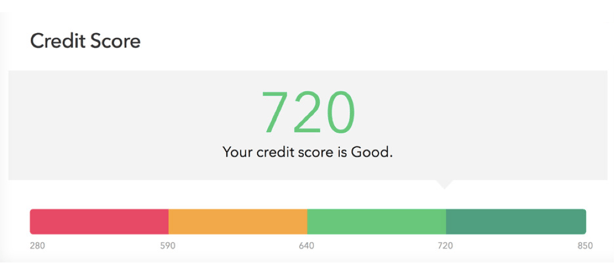

Even Americans with significant credit histories aren’t all happy with where their scores stand. According to FICO’s latest numbers, roughly 1 in 5 Americans have credit scores below 600. Scores in this range could leave consumers facing lender rejection. Last year, more than 38% of would-be borrowers were denied credit or offered less than the amount for which they applied. Another 16% put off applying for credit because they feared being turned down.

If they do obtain a loan, those with subpar scores face significantly higher interest rates than peers with better credit. That translates to uncomfortably large monthly payments, which can be hard for some borrowers to keep up with. Fall behind, and your score will take a hit – continuing the downward credit spiral.

Thankfully, Americans with low or no credit scores don’t have to accept tough terms forever or avoid lenders altogether. If your credit situation is hindering your financial health, there are many techniques at your disposal for improving your score. In this guide, we cover some simple and actionable options you can use to build your credit.

Proven Paths to Better Credit

Building Better Credit - Tools You Can Use

Secured Credit Cards

You give your lender a cash deposit equal to the total amount you can borrow. From there, use your secured credit card as you would any other, paying back charges consistently to demonstrate responsible borrower behavior.

Credit Builder Loans

You take out a loan for a small amount, but your lender keeps the money. Pay it back consistently to build credit, and received the full amount of the loan once you do.

Cosigned Credit

When someone with good credit cosigns with you, you can take out a loan that you couldn't alone. Pay it back responsibly, and both parties benefit.

Authorized User

Someone adds you to their existing line of credit. As payments are made consistently each month, your credit improves, too.

Secured credit cards

Many people are under the mistaken belief that opening a new credit card will hurt their score. And while it’s true there can be a short-term dip from opening a new credit account, having multiple accounts open and using them responsibly over time is one of the best ways to increase your creditworthiness. Secured credit cards are specifically designed to help borrowers build credit. Some Americans are already taking advantage of secured credit card programs, with 5.8 million active lines of credit as of 2013.

Here’s how it works: You give your lender (typically a bank) a cash deposit up front. They hold onto these funds and then give you a line of credit equivalent to that total. You can’t rack up more debt than the initial deposit, so banks have a guarantee they won’t be left holding the bag.

You then use the card like any other and consistently make payments on whatever you borrow. When your lender conveys this pattern of responsible repayment to credit reporting agencies, your credit can be steadily established or improved. Just confirm with your lender this payment activity will be shared with all three major credit reporting agencies: Equifax, Experian, and TransUnion.

Eventually, your lender may offer to upgrade you to a traditional card, with a spending limit larger than the size of your deposit. But even if they don’t, your new credit history should qualify you for a card from another lender.

Credit builder loans

Credit builder loans offer a seemingly contradictory set of benefits: They help you build credit and save simultaneously. They’re often offered by credit unions – nonprofit lenders that serve to help their members and specific communities.

Credit builder loans can be characterized as a loan to your future self. Your lender grants you a small loan, then keeps that money in a savings account you can’t touch. You make payments on that loan over time, demonstrating that you can repay consistently. Your lender then shares that evidence of credit-worthy behavior with reporting agencies.

Once your loan is paid in full, you’re given back the total you borrowed in the first place. Effectively, you’ve saved that money, while also establishing a credit track record. You’ve paid interest for this privilege, but credit builder loans typically offer low rates.

Cosigned credit

Let’s be clear: This is an option you can’t choose alone. To take advantage of the potential benefits of cosigning, someone with strong credit must be willing to cosign a loan with you. They risk taking a hit to their own credit record if you don’t make payments, and they’ll be equally responsible for the debt if you don’t pay it off. That risk requires a lot of trust, so try not to take it personally if your friends or loved ones aren’t eager to assist in this way.

But if someone will go out on that limb for you, cosigning is a great way to get your foot in the door with lenders. They’ll overlook your imperfect credit because they know someone with a higher score will also be on the hook for your balance. Even if you can get a loan without them, your cosigner’s credit could help you secure a better rate.

But beyond any single loan application, cosigning can be an excellent way to build credit in the long run. If the loan is repaid in an appropriate manner, both signatories stand to benefit because credit agencies will record timely payments on each person’s report. Plus, unlike with the first two options discussed, you can build credit while paying off a real purchase. A cosigner will allow you to improve your credit while buying something that will advance your quality of life, such as a car. Just be sure to honor the gift your cosigner has given you by making your payments consistently.

The authorized user option

This possibility is similar to cosigned credit: It requires someone with better credit to give you a chance. Authorized users can employ a line of credit obtained by someone with strong credit. They even get their own credit card, but whatever they borrow is pooled with charges by the primary account holder – that means a single debt balance, as well as one monthly bill. For instance, parents often make their children authorized users, giving them their own cards for a credit line the family shares.

As the account is paid promptly, authorized users benefit from that track record. That’s true even if the authorized user doesn’t use the card very often and regardless of who pays the bills. Of course, you can pay your fair share to the primary account holder each month, so the primary account holder isn’t covering your spending.

Be wary, however, of how another authorized user might affect the shared account’s credit utilization or the percentage of possible credit that’s being used at any given time. With more users, spending will inevitably increase, utilizing a larger percentage of the account’s total limit. Most experts recommend carrying less than 30% of your credit limit as a balance, so everyone’s credit score could suffer if multiple users exceed that amount. Also, be sure your credit card company reports authorized users to all three credit agencies. While nearly all major credit card providers do, some smaller lenders may not.

Making these methods work

While the techniques above are great ways to establish or revive your credit record, they’re just opportunities to demonstrate you’re creditworthy. If you don’t seize them appropriately, your credit troubles will likely continue. No matter which path you choose, make payments consistently and avoid racking up big debts. Here are some specific tips to help you accomplish these goals.

Better credit habits checklist:

- Make payments on time

- When you miss a payment, get back on track immediately

- Keep credit utilization below 30 percent

- Don't close cards too soon

Avoid missed payments like the plague

It’s an obvious suggestion, but one that matters more than many think: Make payments on time. A late payment could damage your score to the tune of 100 points or more and remain on your report for seven years. If you do miss a payment, getting quickly back on track is key. If you make the payment within 30 days of its due date, credit reporting agencies won’t hold it against you.

If you have multiple lenders and loans, keeping track of your bills can be a challenge. Refinancing your debt can be an excellent way to replace various loans with a single one that you can keep up with more easily. You may even be able to secure a lower interest rate, which would equate to lower payments each month.

Keep credit utilization low

We mentioned this element in connection with authorized users, but credit utilization is an essential concern for any credit card you use. Even with a secured card, credit reporting agencies will be concerned if you’re always pushing the limits of what you can borrow.

There are several strategies to avoid carrying more than 30% of your total credit limit on each of your cards. The first step is knowing your limit for each line of credit, so you can identify when you’re in danger of exceeding that range. If you have multiple cards, you may need to be intentional about distributing charges among them. Having a couple of cards with balances below 30% is usually better than borrowing big on a single card.

This might be one reason to hold off on closing a credit card, even if your balance is low. While it might feel satisfying to eliminate a card altogether, that could cut down the total credit available to you, sending your credit utilization through the roof.

Giving yourself options

Building good credit can expand your financial choices, opening exciting doors. A strong credit score allows you to make many purchases at rates that seem strikingly reasonable. But these opportunities can be overwhelming, with a myriad of lenders and expenses to choose from. Remember the techniques that helped you improve your credit, and your score should stay strong in the years to come. The basic principles of building credit are also integral to its maintenance, even if you enjoy more options.

If you want to learn how to live within your means in the present and work toward a comfortable future, Comet is ready to help. Our resources cover a range of financial topics, offering Americans a chance to educate and empower themselves. From building credit to buying a home, we’ll ensure you make the most of your money.