Why Paying Ahead—Even Just a Little—Can Have a Big Impact on Your Student Loans

Paying extra on your student loans every month can make a big dent over time—even if you only tack on as much as the price of a movie ticket.

How can a few extra bucks a month make a difference? Let's talk about how this works.

When your student loan is new, most of your monthly payment is applied to your interest—not your principal. That’s why, if you just started paying off your loan, you might notice that your balance isn’t budging even though you’re up to date on your payments.

Later on, the interest v. principal balance shifts—and more of your payment is applied to the principal. Then you’ll start to see more progress, but this takes several years or more to occur.

However, if you make more than the minimum payment, lenders have to put that directly toward the principal—it’s the law—as long as you don’t have any accumulated fees or overdue interest to pay off first.

If you make more than the minimum payment, especially early on, it can make a big difference in your principal. Lower principal = less interest charges every month. That can lead to big-time savings over the long run.

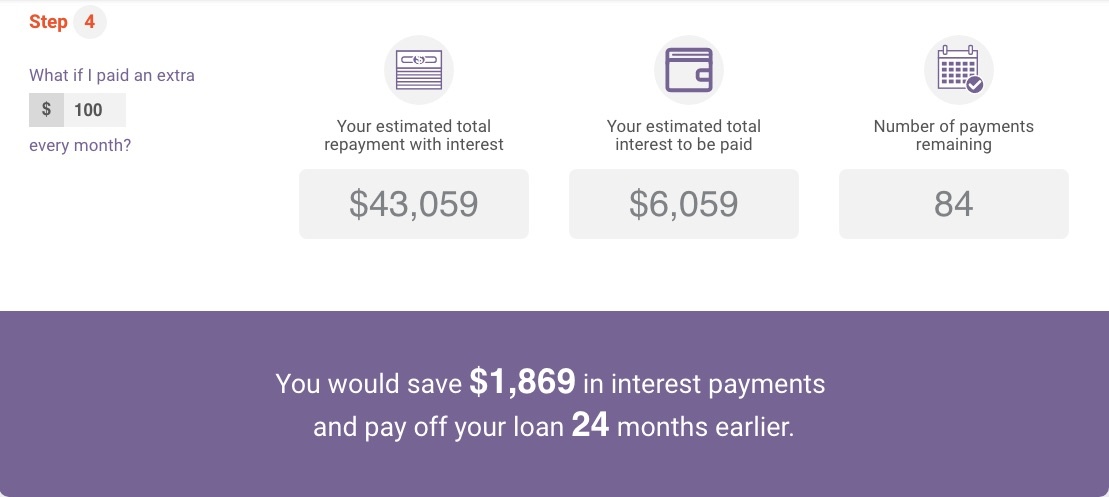

And just to show you, we’ve run some numbers in our Student Loan Repayment Calculator

See Also: Paying Off Student Loans

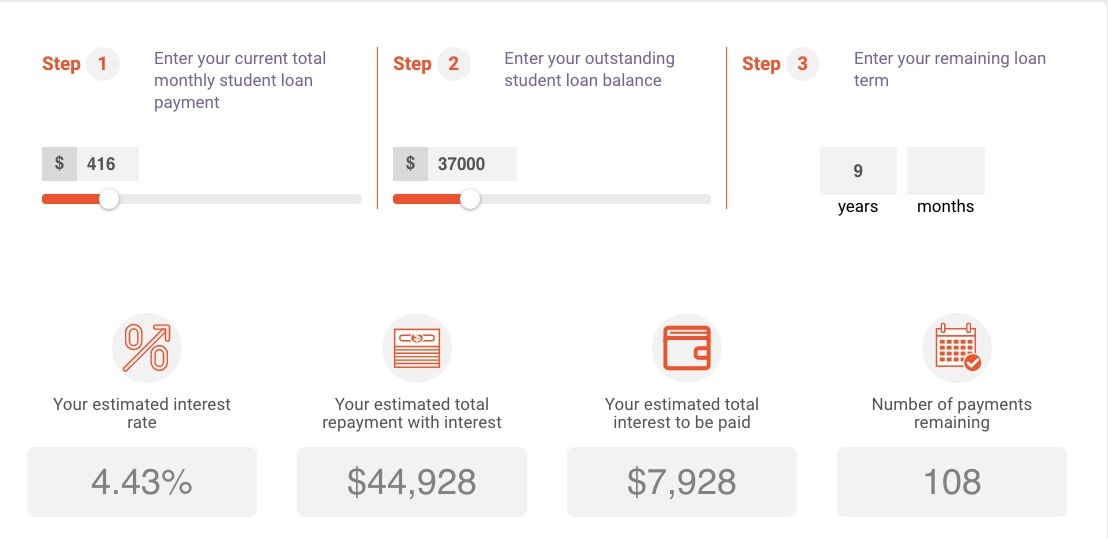

Let’s say you have a $37,000 student loan—around the national average—and you’ve got nine years to pay it off. You pay $416 per month.

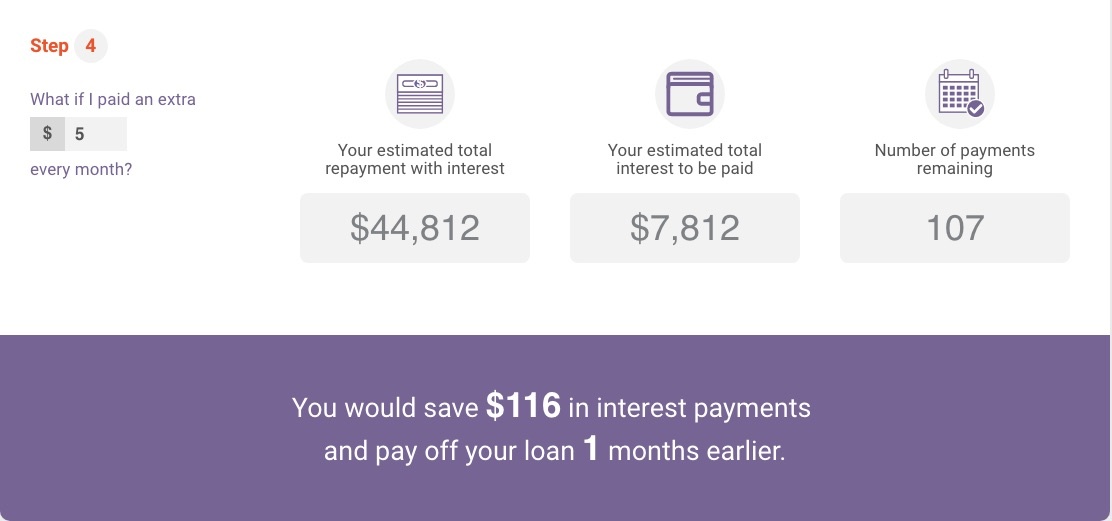

If you kicked $5 extra toward your student loan every month—a little more than what you’d pay for a latte—you’d get out of your loan a month early, and save $116 in interest.

It’s not a lot—although an extra $116 in your pocket never hurt anyone. But what happens if you paid $20 extra toward your loan?

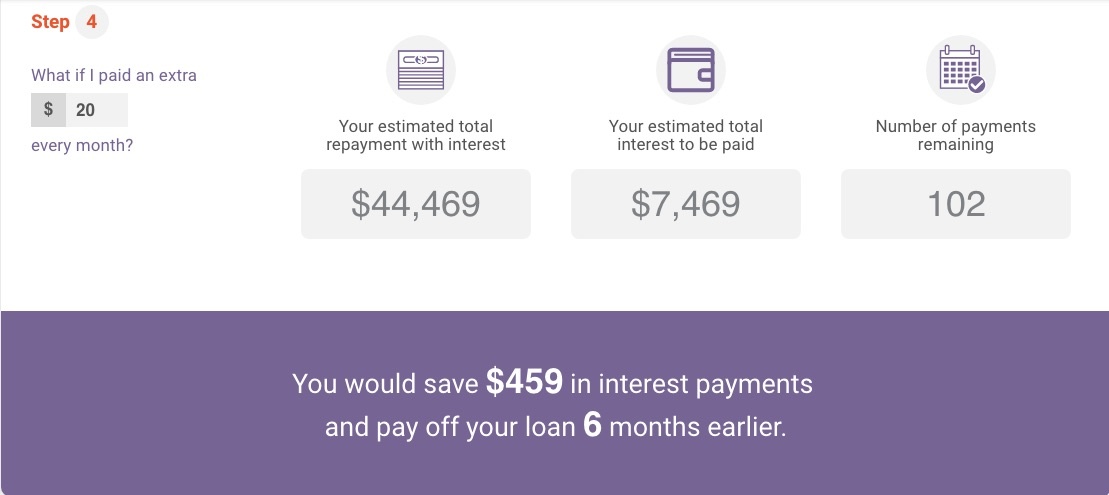

You save $459 in interest over the term of your loan—and pay it off six months early.

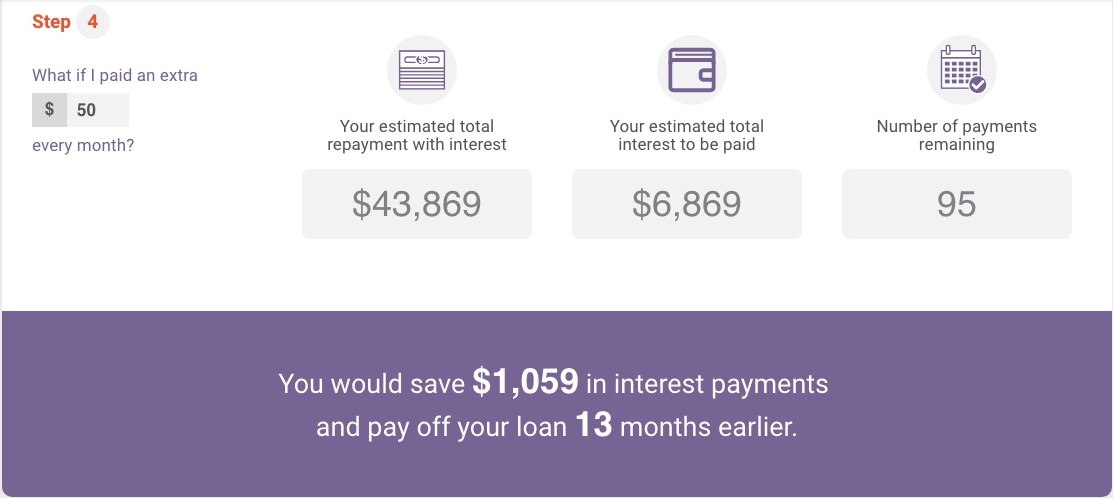

And if you put an additional $50 per month toward your loan, you save $1,059 in interest—and get out of your loan more than a year ahead of time.

You really start to see some benefits if you can find an extra $100 per month to put toward your loans. In that scenario, you save almost $2,000 in interest—and kill your loan two years ahead of the due date.

Sure, the extra interest savings are great—but to many people, the real gift is the time. What would you do with two extra years of your life without student loans?

You don’t have to put a ton of extra money toward your student loan every month to make a dent. What you can afford—from as little as $5 to as much as $100—can buy you both money and time.

Want to find out how much you could save by refinancing? See if you're Refi Ready.