6 Ways to Minimize the Size of Your Student Loan

How much is too much when it comes to student loans?

That can be a hard question to answer,...

Enter the $2,000 Nitro Scholarship now! Apply in 3 Minutes!

Nitro Knowledge. Your Guide to Paying for College.

How much is too much when it comes to student loans?

That can be a hard question to answer,...

As a parent, you'll explore all avenues to find funds for your child's college...

You’ve started doing the math and you don’t like where it’s going. Between scholarships, grants,...

In a survey of over 1,200 parents, we've learned that 29% of them made their decision on student...

Last updated: March 2017

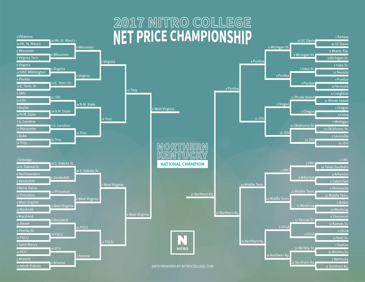

It’s that time of year again, when madness overtakes March. But forget the...

A private student loan is a loan that you take out from a private lender (like a bank) to cover...

When you borrow money to pay for college, in many cases, you’ll be charged a fee to borrow it. In...

If you’re like many college students, you’re managing a full course schedule during the day and...

Your college tuition is probably pretty expensive. If you're like most of the population, you can't...