3 Ways to Lower Your Great Lakes Student Loan Payment

Millions of borrowers in the United States are struggling to make their student loan payments each month. If you’re one of them, there are two important things you should know: you’re not alone, and you can lower your payments.

We’ve put together a list of three of the best ways to lower your Great Lakes monthly payments right now. One of them could even lower the amount you pay over the life of the loan. (Spoiler alert: It’s refinancing.)

No matter your financial situation or your career goals, we have an option for you.

1. Change your repayment plan

If you’re currently making payments under a standard repayment plan — the plan you’re automatically enrolled in when you graduate — then your payment amounts are based on you being able to pay the loan off in 10 years.

Unfortunately, a 10-year repayment plan is too aggressive for many borrowers. To provide some relief, the federal government offers income-driven repayment programs.

An income-driven repayment plan is exactly what it sounds like — a plan that bases your monthly payment amount on your income. There are four different types of income-driven plans, and they each set your monthly payment amount at 10-20% of your discretionary income and extend your repayment term to 20 or 25 years.

Any remaining balance at the end of the term will be forgiven. Though loan forgiveness is every borrower’s dream, know that this forgiveness comes at a price: you have to pay taxes on the forgiven balance.

See also: The Ultimate Guide to Student Loan Forgiveness

Income-driven plans can be very helpful for some borrowers, but be aware that spreading out your payments over a longer may lead to you paying more over the life of the loan. Why? Because you’ll be paying interest longer.

You can enroll in income-driven repayment by going to the Federal Student Aid website or by contacting Great Lakes.

2. Consolidate your loans

When you consolidate your federal loans with a Direct Consolidation Loan through Great Lakes, you replace multiple loans with a single loan. And that single loan has a single payment. Handy, right?

Consolidation could lower your monthly payment if you extend the term of your loan (for instance, from a 10-year standard term to a 30-year extended term), but it won’t reduce your interest rate. In fact, your new interest rate is the weighted average of all your loans rounded up by an eighth of a percent, so consolidating may actually increase your interest rate slightly.

A few things to keep in mind: if you reduce your payments this way, you’ll be paying more over the life of the loan. And while your loan will still be eligible for income-driven repayment, any payments you might have made toward Public Service Loan Forgiveness will no longer count in that program. You’ll have to start over with qualifying payments.

You can find out more about consolidating your Great Lakes loans here.

3. Refinance through a private lender

Refinancing through a private lender is the only way to lower both your monthly payment and your interest rate. Current refinancing rates are lower than federal student loan rates for qualified borrowers, and that could mean significant savings.

Both federal and private loans are eligible for refinancing with a private lender. However, it’s important to know that if you refinance federal loans with a private lender, you will lose access to certain federal benefits such as income-driven repayment or Public Service Loan Forgiveness.

Of course, the savings — both monthly and in the long-term — could be enough to make up for any loss of benefits. Here’s how it works:

Sample refi scenario

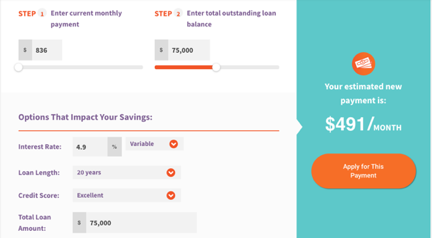

Let’s say all of your student loans are from graduate school, and those have a high interest rate. You graduated with $75,000 in loans at a 6.08% interest rate — the current rate for federal graduate student loans. Your monthly payment is $836.

You have great credit, so you’re able to refinance for an interest rate of 4.9% and a new loan term of 20 years. Your new monthly payment is $491, which means you have $300 more in your bank account every month. (Of course, it’s important to consider whether you should choose a variable or fixed interest rate. Learn more here.)

What's your next move?

If you think refinancing could work for you, check your own numbers in our Student Loan Refinancing Calculator.

Of course, everyone’s situation is different, but any one of these options is better than defaulting on your loans. Take action to lower your payments now.

Refinance & Save Today With These Leading Lenders

View More Details

View More Details

Special offers for medical resident and fellow refinance products

- Fixed rates: 4.39% - 9.24% APR

- Variable rates: 2.50% - 9.24% APR

- Minimum credit: 650

Splash Financial is a leader in student loan refinancing with some of the lowest fixed in the industry which can save you tens of thousands of dollars over the life of your loans. No application or origination fees and no prepayment penalties. Splash Financial is in all 50 states and is intensely focused on customer service. Splash Financial is also one of the few companies that offers a great medical resident and fellow refinance product. You can check your rate with Splash in just minutes.

- Low interest rates – especially for graduate students

- No application or origination fees. No prepayment penalties.

- Co-signer release program - you can apply for a cosigner release form your loan after 12 months of on-time payments

- Specialty product for doctors in training with low monthly payment

Click here to see more of Splash's offerings and to see how you can save money.

View More Details

View More Details

SoFi is the leading student loan refinancing provider.

- Fixed rates: 3.99% - 8.24% APR

- Variable rates: 2.49% - 7.99% APR

- Minimum credit: 650

$30 billion+ in refinanced student loans. SoFi has some of the lowest interest rates and, unlike the other lenders we reviewed, there's no maximum on the amount you can finance. Some state restrictions may apply.

- Serious savings: Save thousands of dollars thanks to flexible terms and low fixed or variable rates.

- No hidden fees, no catch: No application or origination fees. No pre-payment penalties.

- Fast, easy, and all online: Simple online application and access to live customer support 7 days a week.

- Access to member benefits: SoFi members get career coaching, financial advice, and more—all at no cost.

- 98% of surveyed members would recommend SoFi to a friend

Save thousands on your student loans and pay off your loans sooner. Find your rate.

View More Details

View More Details

Works with 300+ community lenders for higher approval chances

- Fixed rates: 2.49% - 7.75% APR

- Variable rates: 1.90% - 5.25% APR

- Minimum credit: 660

Connecting student borrowers to a network of over 300 community lenders with low interest rates. By partnering with these lenders, LendKey is able to give consumers direct access to the best rates available from the most borrower friendly institutions. As the servicer of all loans obtained through its platform, you can rest easy knowing your personal information will be safe and that the best customer service team will be ready to answer your questions from application until your final payment.

- Lightning fast rate check - 2-minute rate check with no impact on your credit score

- More lenders, more options - see the best offers from over 300+ community lenders for higher approval chances

- Life of loan relationship - With LendKey, your personal information will never be sent or passed on to third parties. Their customer service team is with you from the moment you land on their website until you've completely repaid your loan.

- Unmatched benefits- Community lenders put people over profits and offer unique benefits like cosigner release after 12 on-time payments, interest only repayment options to keep monthly payments low, the largest unemployment protection period in the market, and more.

View More Details

View More Details

Best for borrowers who want to customize their repayment schedule to pay off debt fast.

- Fixed rates: 4.39% - 8.99% APR (with 0.25% autopay discount)

- Variable rates: 3.99% - 8.29% APR (with 0.25% autopay discount)

- Minimum credit: 650

Using technology, data, and design to build affordable products, Earnest's lending products are built for a new generation seeking to reach life's milestones. The company understands every applicant's unique financial story to offer the lowest possible rates and radically flexible loan options for living life.

- Commitment-free 2 minute rate check

- Client Happiness can be reached via in app messaging, email, and phone

- No fees for origination, prepayment, or loan disbursement

- Flexible terms let you pick your exact monthly payment or switch between fixed and variable rates

- Skip a payment and make it up later

- Online dashboard is designed to make it easy to apply for and manage your loan

Click here to apply with Earnest and to see how much you can save.